are raffle tickets tax deductible if you don't win

If you win a charity raffle. Thats because you are not actually making.

Show Me The Money Raffle La Mesa Chamber Of Commerce

Are raffle tickets tax deductible if you dont win Friday February 11 2022 Edit.

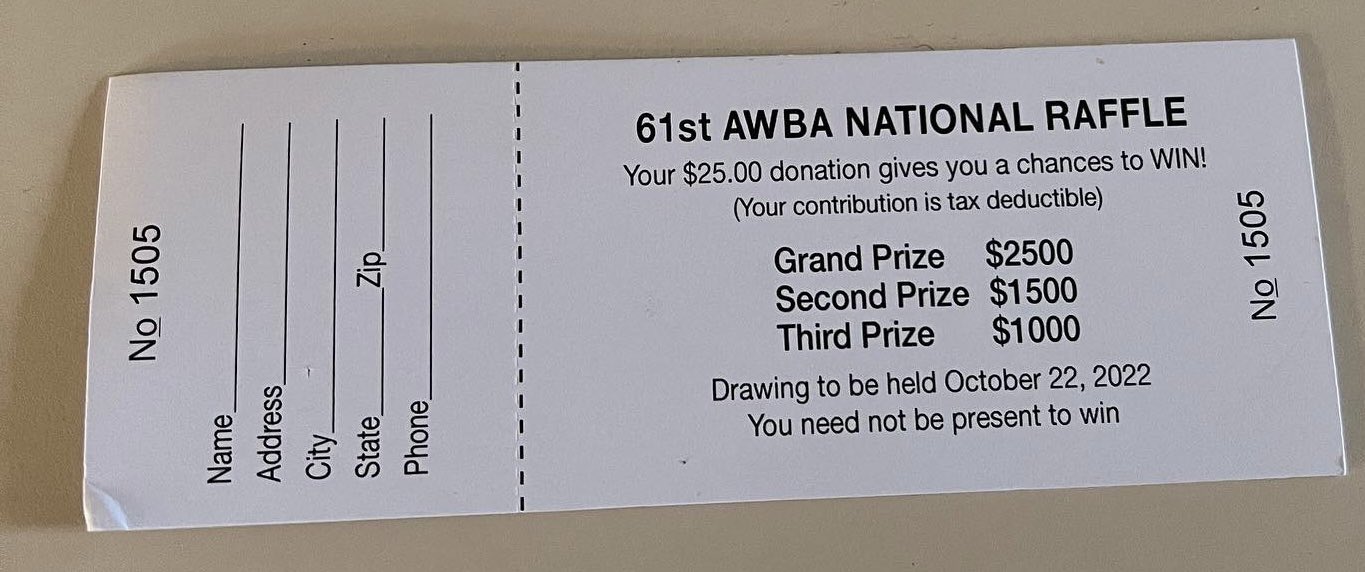

. The IRS allows you to write off gambling expenses but only up to the amount of your winnings. Unfortunately purchasing a raffle ticket to benefit a non-profit organization is not a tax-deductible expense. Are Raffle Tickets Tax Deductible If You Dont Win.

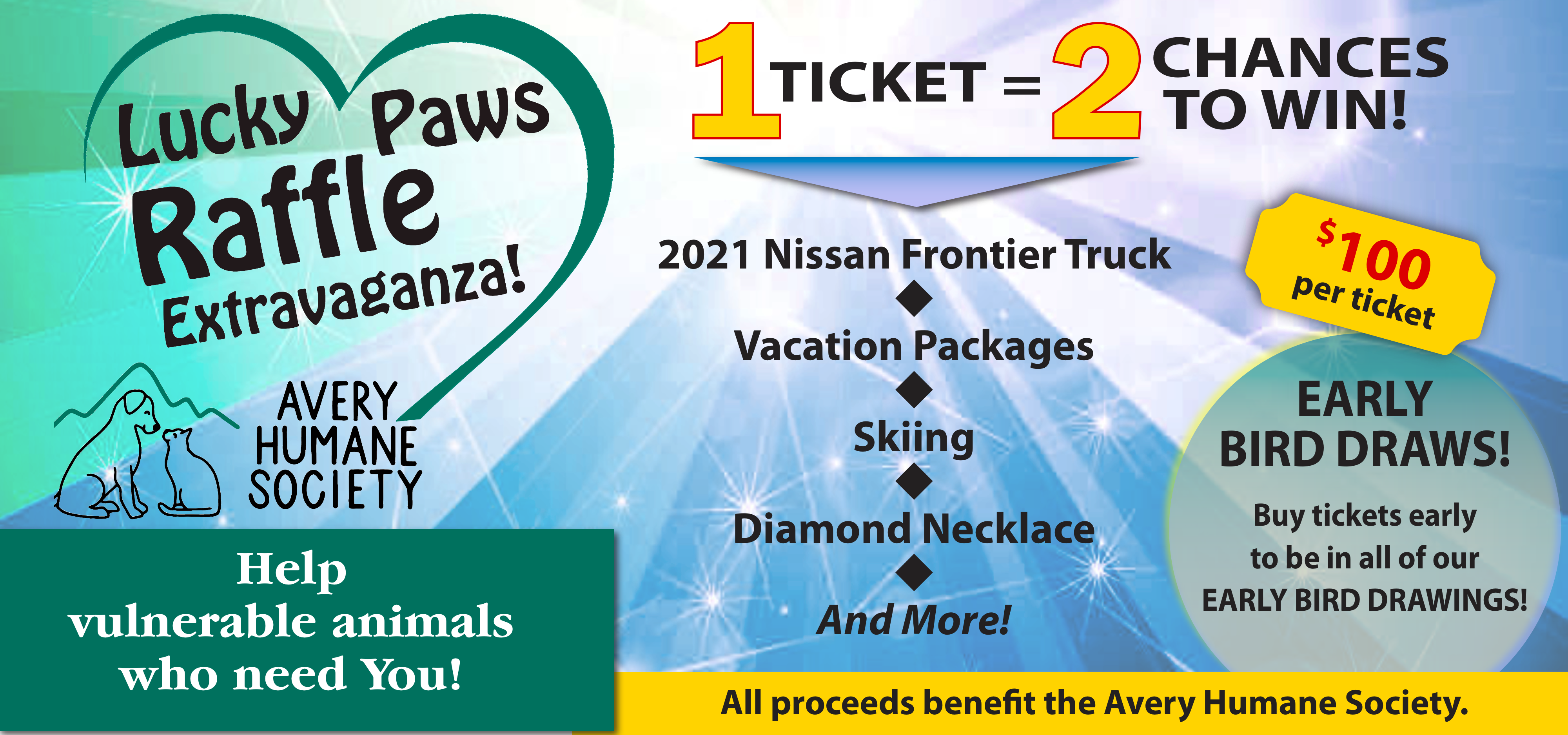

In general a raffle is considered a form of lottery. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. If you buy 20.

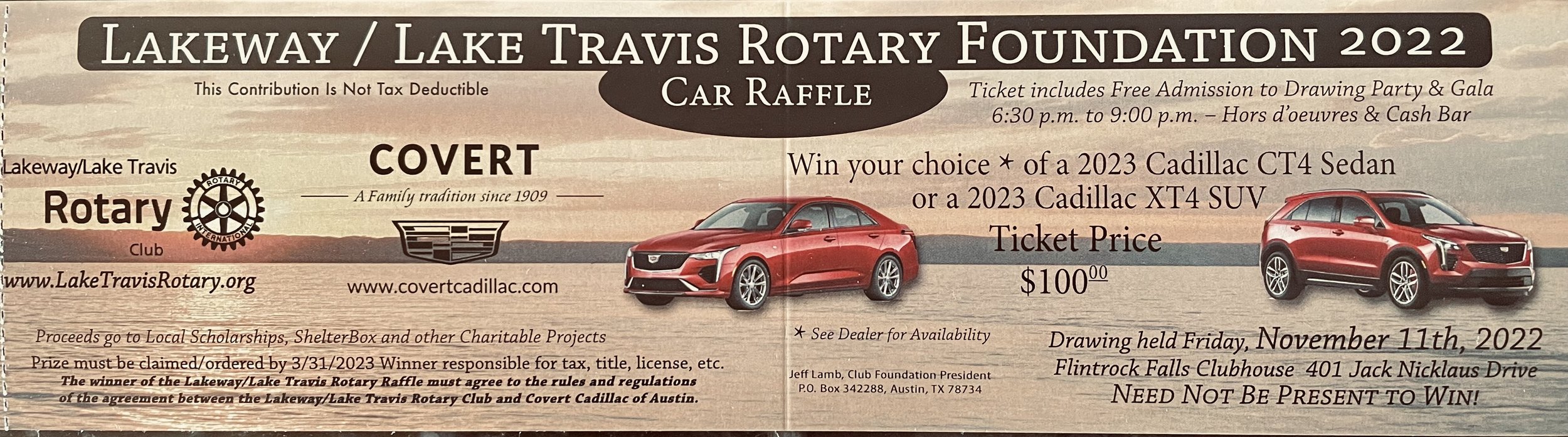

Are raffle tickets tax deductible if you dont win. Reporting Raffle Prizes Raffle Defined. For example if raffle tickets are 50 and the prize is a 20000 car greater than 50 x 300 then the organization would have to report the winnings to the IRS on a W-2 G.

Thats because you are not actually making. Please remember even if you dont win this raffle item. Are raffle tickets tax deductible if you dont win.

Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. If you dont win are raffle tickets tax deductible. An organization that pays raffle prizes must withhold 25 from the winnings and report this amount to the irs on form w.

The IRS allows you to write off gambling expenses but only up to the amount of your winnings. Winners are encouraged to consult a tax professional. As such a raffle generally.

Is it possible that tickets are. Are raffle tickets tax deductible if you dont win. Are raffle tickets tax deductible if you dont win.

Thats because you are not. One way to write off your raffle ticket is as a gambling loss. The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization.

Are raffle tickets tax deductible if you dont win. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense. The IRS considers a raffle ticket to be a.

Are Raffle Tickets Tax Deductible The Finances Hub Are Nonprofit Raffle Ticket Donations Tax. Also be required to withhold and remit federal income taxes on prizes. Are Raffle Tickets Tax Deductible If You Dont Win.

The cost of a raffle ticket is not deductible as a charitable contribution even if the ticket is sold by a nonprofit organization. If youre lucky enough to. The IRS doesnt allow a charity tax deduction for raffle tickets you purchase a part of a charity fundraiser because it treats the tickets as gambling losses.

Although you cannot take a. Ask your local tax professional if you have any questions. Unfortunately buying a raffle ticket to support a nonprofit organization is not a deductible expense.

First Texas Honda Raffle Thundercloud Subs Turkey Trot

Using Ma Aser Money For Raffle Tickets The Bais Havaad Halacha Center

4000 In Visa Prepaid Debit Cards Raffle Creator

Communities In Schools Raffle For Change Thank You For Participating

Life Matters Benefit Abc Pregnancy Resource Center

Raffle Rotary Club Of Austin Westlake

Fundraising Raffles Rules Regulations

Communities In Schools Raffle For Change Thank You For Participating

Keuka Comfort Care Home Jeep Cherokee Raffle Friendly Cdjr

Kosciusko County Sheriff S Office Warsaw In Facebook

Fun Fact Charity Raffle Tickets Are Not Tax Deductible

Lucky Paws Raffle Extravaganza

Are Nonprofit Raffle Ticket Donations Tax Deductible

2023 Vacation Raffle Havenhouse St Louis Fundraiser Raffle

The Aging Solutions Central Ohio Area Agency On Aging Facebook

2022 Ford Maverick Lariat Hybrid One Raffle Ticket Kxci

Tax Deductions You Should Claim And Five You Can T Prosperity Thinkers