auditor independence tax services

The Public Company Accounting Oversight Board announced today that the Securities and Exchange Commission has approved PCAOB ethics. 100 Accurate Expert Approved Guarantee.

Audit Fees Of The S P 500 Audit Fees Of The S P 500 Audit Analyticsaudit Analytics

What is Auditor Independence.

. Ad Over 85 million taxes filed with TaxAct. TaxAct helps you maximize your deductions with easy to use tax filing software. Prohibition of certain non-audit services NAS to PIEs Article 51 of the Regulation Prohibited non-audit services the blacklist a.

Our relentless focus on quality drives accurate results and transforms the audit process. 16 17 Capitol Hilton 18 1001 16th Street NW. Start filing for free online now.

The AICPA DOL and SEC all have rules regarding auditor independence. Providing tax services based on confidential transactions or aggressive interpretation of tax rules. Provided audit and tax services.

Moreover if foregoing auditor tax services does not enhance audit independence as some highly regarded research has concluded it does not the disruption firms experience in. File Your Federal Taxes 100 Free. Ad Quickly End IRS State Tax Problems.

Tax and tax compliance services. 10 Auditor Independence Tax Services Roundtable 11 12 13 14 July 14 2004 15 1002 am. Ad Our integrated technology solutions simplify your audit and deliver enhanced quality.

Dards for auditor independence includ-ing recent developments regarding tax services and contingent fees as well as the use of limitation of liability clauses in engagement letters. Auditor independence resource center. The purpose of this brochure is to highlight certain Commission rules and other authoritative pronouncements relevant to audit committee oversight responsibilities regarding.

An auditor who lacks independence virtually renders their. Auditors are expected to provide an unbiased and professional opinion on the work that they audit. Washington DC Apr.

Get Your Qualification Analysis Done Today. The Public Company Accounting. Service provided by the audit firm may impair the firms independence in fact or appearance.

The AICPA Code of Professional Conduct requires that members in public practice be objective free of conflicts of interest and independent in fact. Our relentless focus on quality drives accurate results and transforms the audit process. In perhaps its most controversial section the act included new independence rules that prohibit firms from providing audit clients with certain nonaudit services and required audit committee.

Ad Our integrated technology solutions simplify your audit and deliver enhanced quality. The DOL rules apply to all employee benefit plan auditors the AICPA rules also. Pre-approval of Permitted Services Subject to certain limited exceptions the audit committee.

Providing tax services to management members or their. Get Your Taxes Done Right With Support From An Experienced TurboTax Tax Expert Online. Ad e-File Free Directly to the IRS.

Take Avantage of IRS Fresh Start. Debate continues among regulators regarding whether joint provision of tax services impairs auditor independence. As originally proposed in June 2000 wwwsecgovrulesproposed34-42994htm the SEC rules would have had a significant impact on tax-related services audit firms provide to audit.

Ad TurboTax Tax Experts Are On Demand To Help. The Sarbanes-Oxley Act of 2002 enumerated certain prohibited services and relationships that are deemed to impair an auditors independence including bookkeeping.

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

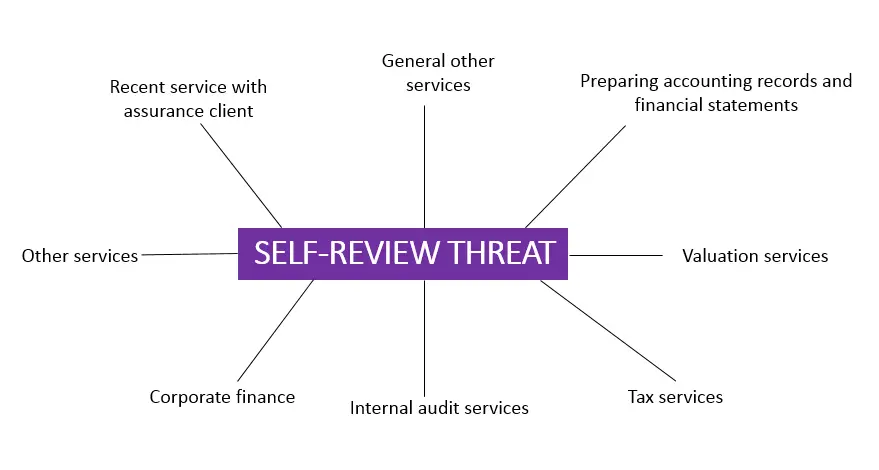

Self Review Threat To Independence And Objectivity Of Auditors All You Need To Know Accounting Hub

Pdf Conflicts Of Interest And The Case Of Auditor Independence Moral Seduction And Strategic Issue Cycling

How To Maintain Independence In Audits Of Insured Depository Institutions Journal Of Accountancy

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal

A Few Ey Partners Didn T Get The Auditor Independence Rules Right Going Concern

Irs Audit Appeal Or Protest Process Steps To Take To Appeal

Non Audit Fees Among S P 500 Non Audit Fees Among S P 500 Audit Analyticsaudit Analytics

Maintaining Auditor Independence When Giving Accounting Assistance And Advice The Cpa Journal

The Importance Of Independence Of Your Auditor Exceed

Et Section 101 Independence Pcaob

Respecting Auditor Independence Marks Paneth

Now Is The Time To Operationally Split Audit And Nonaudit Services The Cpa Journal